What Exactly Is an X-Invoice API

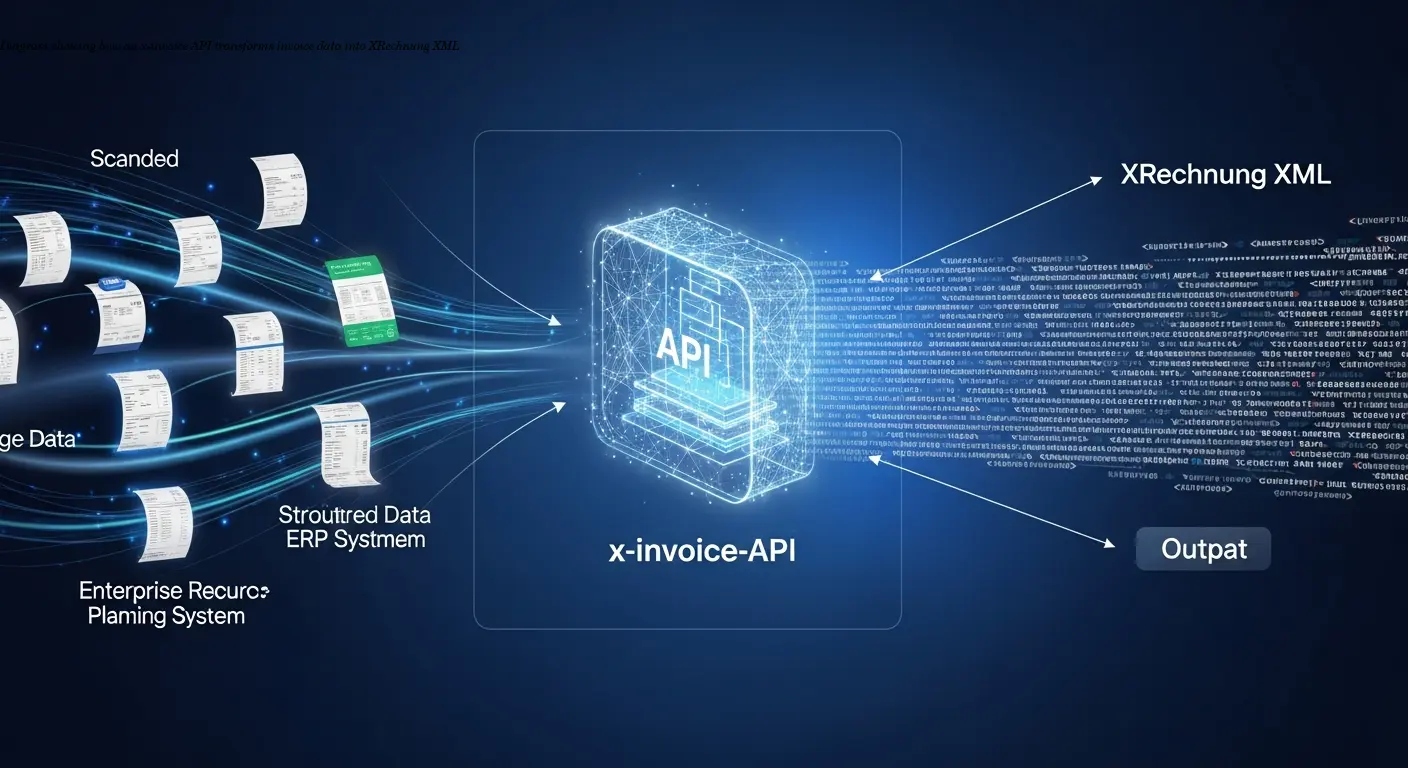

An x-invoice api is a software interface that allows your systems to programmatically generate XRechnung documents. If you're billing German government agencies or public institutions, this format is mandatory — XRechnung has been legally required since 2020 for invoices to German public sector clients.

In practice, the API accepts invoice data — customer details, line items, tax rates, payment terms — and returns a validated XRechnung XML file. Most providers expose a REST interface: you send a POST with JSON (or XML) and receive either the compliant XML or a descriptive error response. The underlying XML conforms to UBL or UN/CEFACT CII schemas, both with strict validation rules.

"The first integration I did saved ~15 hours per week of manual XML work after about two weeks of implementation."

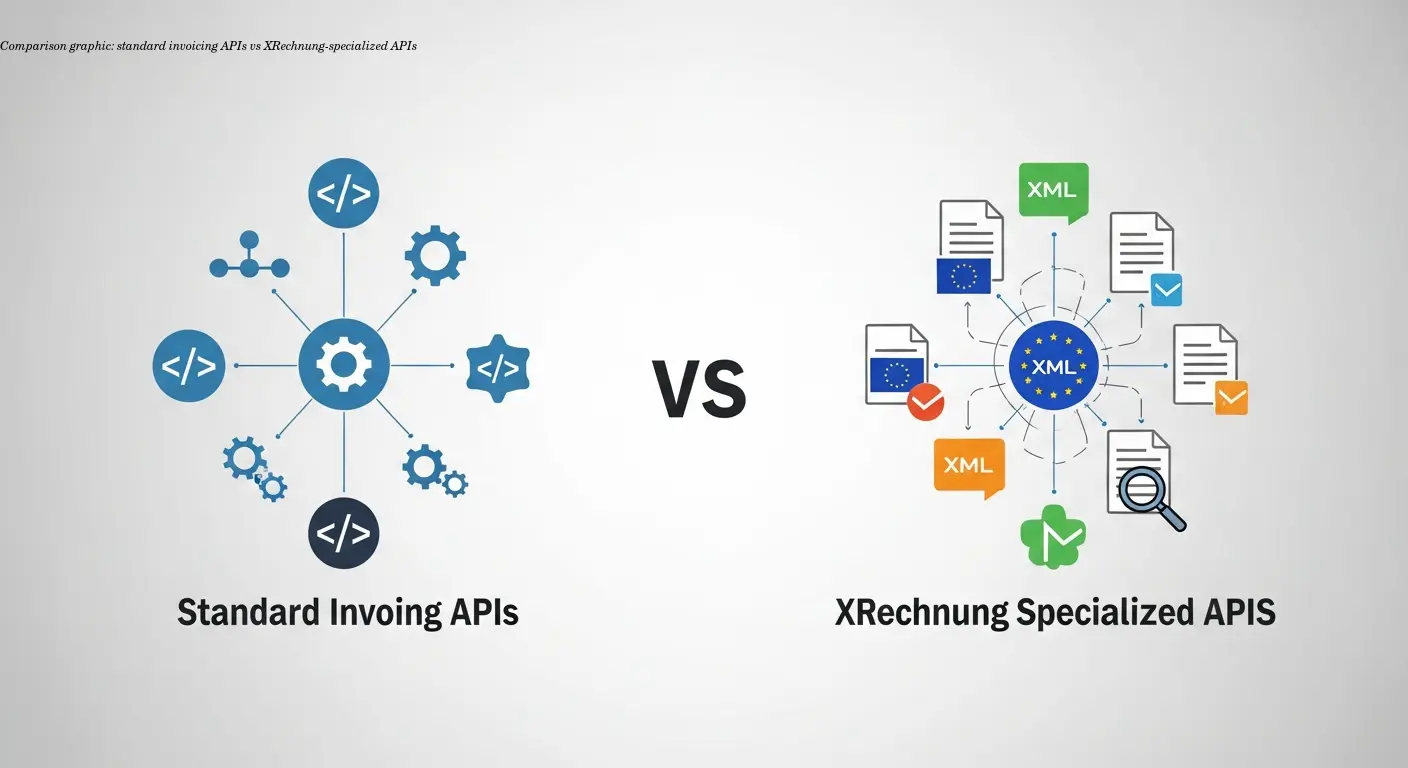

Why Standard Invoicing APIs Don't Cut It

General-purpose invoicing APIs (e.g., Stripe, Bill.com) are flexible, but they prioritize ease-of-use over regulatory specificity. XRechnung requires precise XML elements such as Leitweg-ID, specific tax categorization codes, and legally structured payment terms. A PDF — even with correct visible data — won't satisfy public-sector portals.

Lesson learned: retrofitting a general API often takes far longer than adopting a purpose-built x-invoice api. The validation layer alone makes specialized APIs worthwhile — they catch issues before submission to government portals.

Core Features Your X-Invoice API Should Have

Must-haves:

- Generation of valid XRechnung XML in UBL or CII formats (current schemas).

- Comprehensive validation with field-level error messages (tax IDs, invoice numbers, required elements).

- Integration tooling: SDKs, REST/JSON endpoints, and sample payloads for common languages.

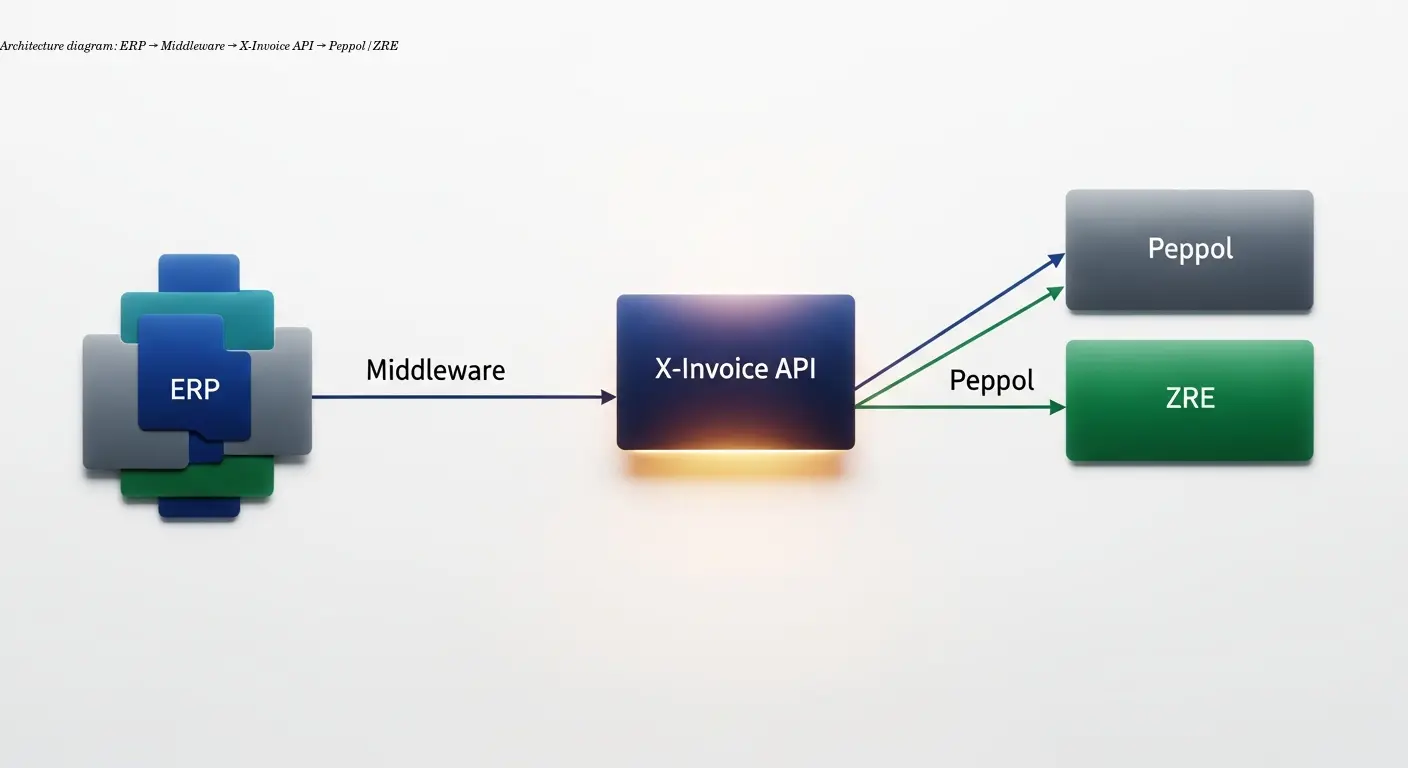

- Transmission options: Peppol, ZRE portals, direct portal uploads, and tracking of delivery/statuses.

- Transformation utilities to convert other invoice structures or PDFs into XRechnung XML.

The best APIs return detailed error objects like invoice.seller.taxID: Invalid format, expected DE123456789, which dramatically reduces debugging time.

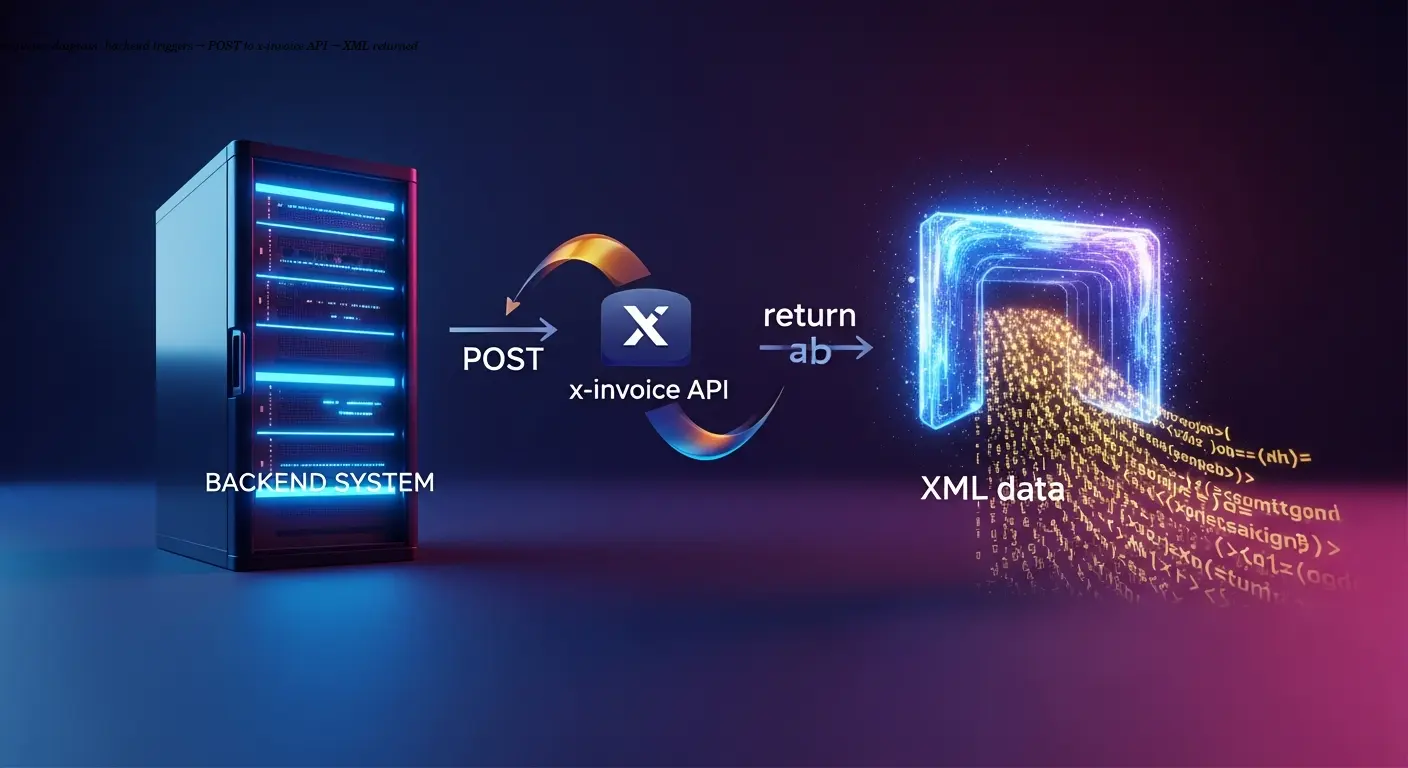

Implementing an X-Invoice API in Your Stack

Typical workflow:

- Collect invoice data from your DB, ERP, or order system.

- Structure the payload according to the API spec (JSON with nested objects for parties, line items, taxes).

- POST to the API; handle 200/201 success, 400-level validation errors, and 500-level server issues.

- Store returned XML or reference URL; track delivery status if transmission is handled by the API.

For production, implement robust error handling, retries, logging for audit trails, and a queue to avoid blocking operational workflows during transient failures.

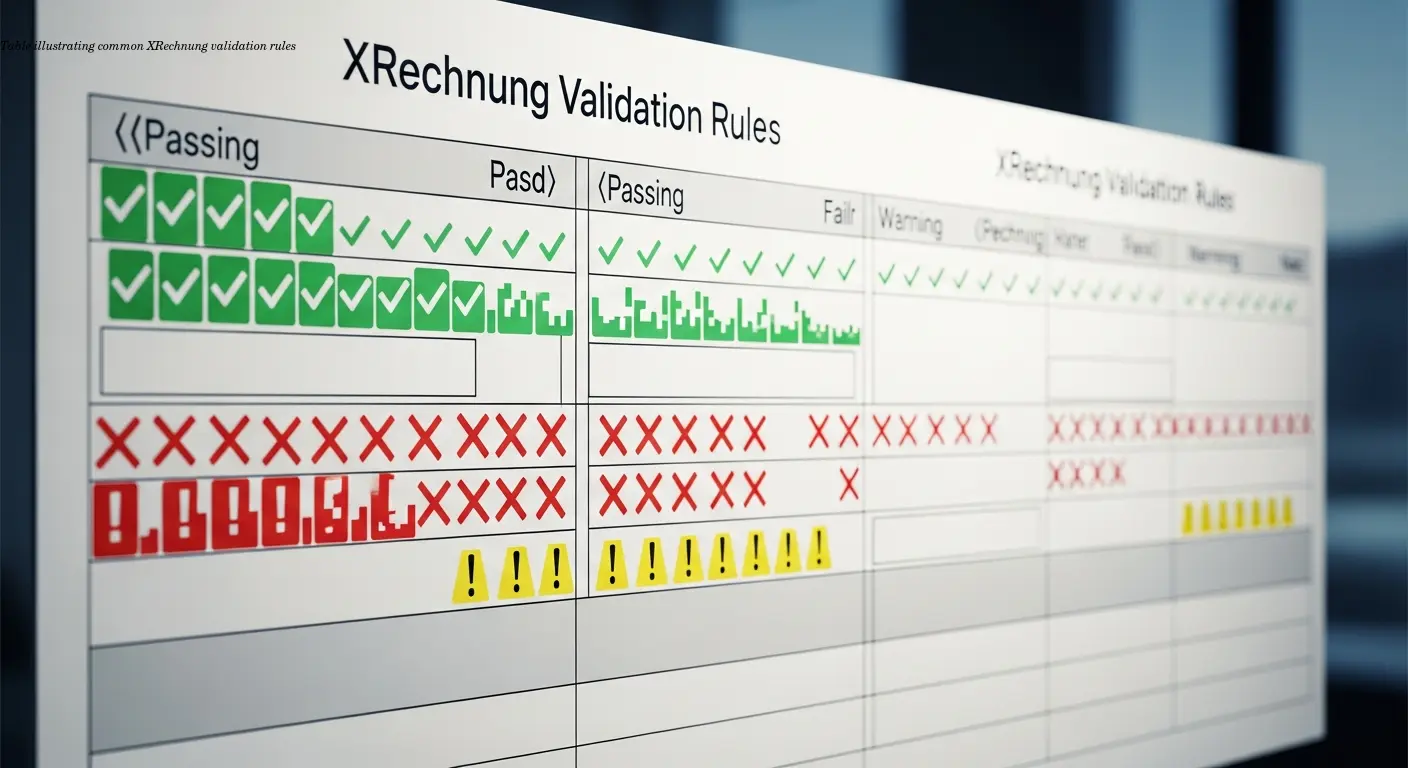

Validation and Compliance Checking

Why validation matters: XRechnung contains dozens of mandatory and conditional fields across a long specification. Manual validation is error-prone and slow. An API that verifies invoice number uniqueness, tax calculations, tax category codes, date formats, and required identifiers (like Leitweg-ID) saves time.

Field-level error responses are critical. Replace generic errors with actionable messages so developers can fix issues quickly. Well-tested providers surface edge cases (e.g., extra spaces in tax IDs) that cause portal rejections.

Real-World Integration Patterns

Common patterns:

- Direct ERP integration: ERP generates invoice and calls the API; XML stored with the invoice record.

- Batch processing: Collect invoices and send them in scheduled batches to optimize rate limits.

- Middleware/microservice: A facade that handles transformation, retries, caching, and provider swap-outs without touching upstream systems.

- Multi-tenant SaaS: Use account-specific tokens and isolated storage to prevent data leakage between customers.

A microservice approach makes it easy to change providers and centralizes XRechnung-specific logic.

Choosing the Right API Provider

Evaluate providers on:

- Compliance: Test sample outputs with official validators.

- Documentation: Clear endpoints, examples, and error references speed integration.

- Support & reliability: SLAs, status pages, and responsive support are essential.

- Pricing: Compare per-invoice vs subscription tiers and watch for hidden fees.

- Integration tooling: SDKs and plugins reduce development time.

Some platforms also offer web interfaces for manual invoice creation in addition to APIs — useful for mixed workflows.

Future-Proofing Your Implementation

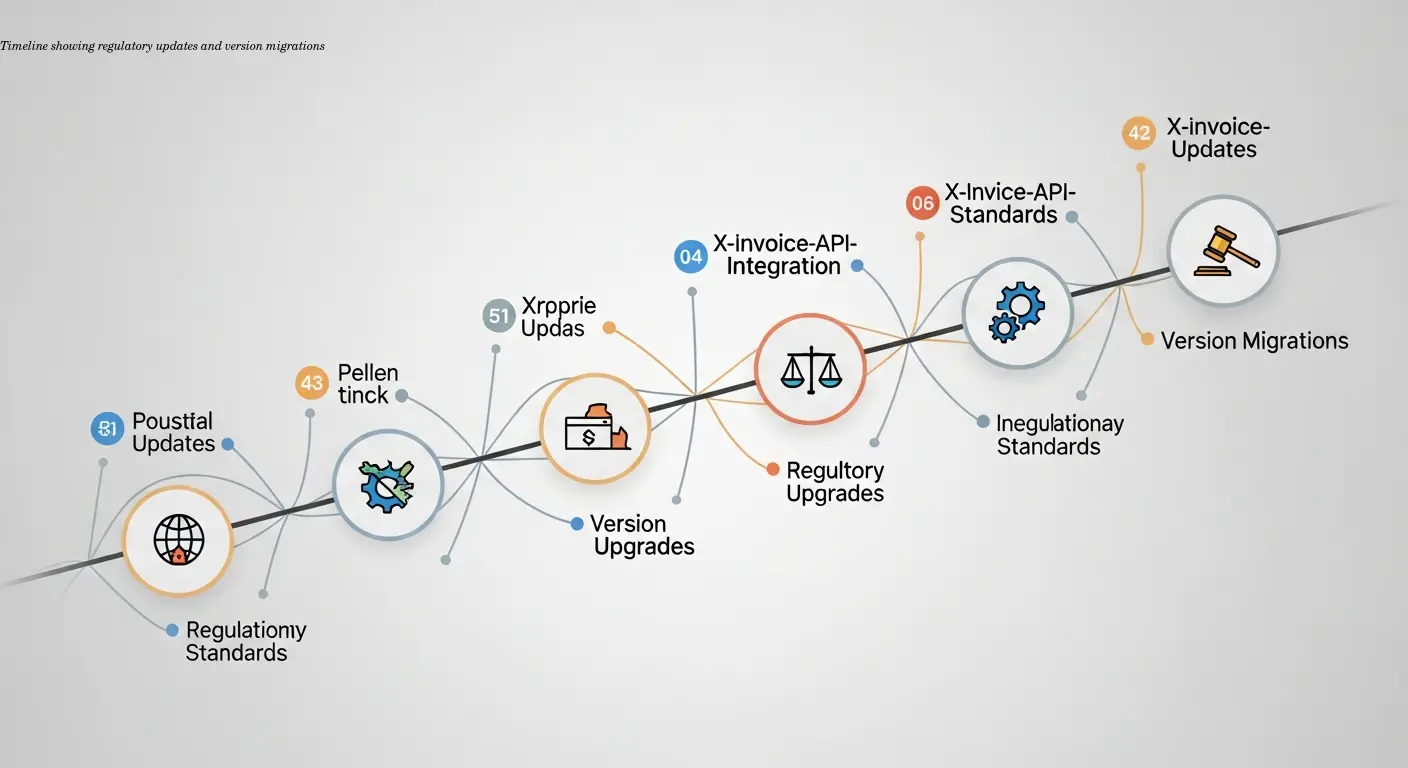

Regulatory change is constant. Germany is expanding mandatory e-invoicing to B2B from 2025, and the EU continues harmonization efforts. Choose providers that actively maintain schemas and announce updates with migration windows.

Practical tips:

- Keep client code modular and versioned → switch API versions with minimal disruption.

- Retain original invoice data and generated XRechnung XML for audits.

- Periodically validate generated invoices against official validators even if the API indicates success.

- Plan for scaling and rate limits; have an upgrade or provider-switch path ready.