How to Create EU-Compliant E-Invoices: A Practical Guide for SMEs

Estimated reading time: 8 minutes

- Key takeaways

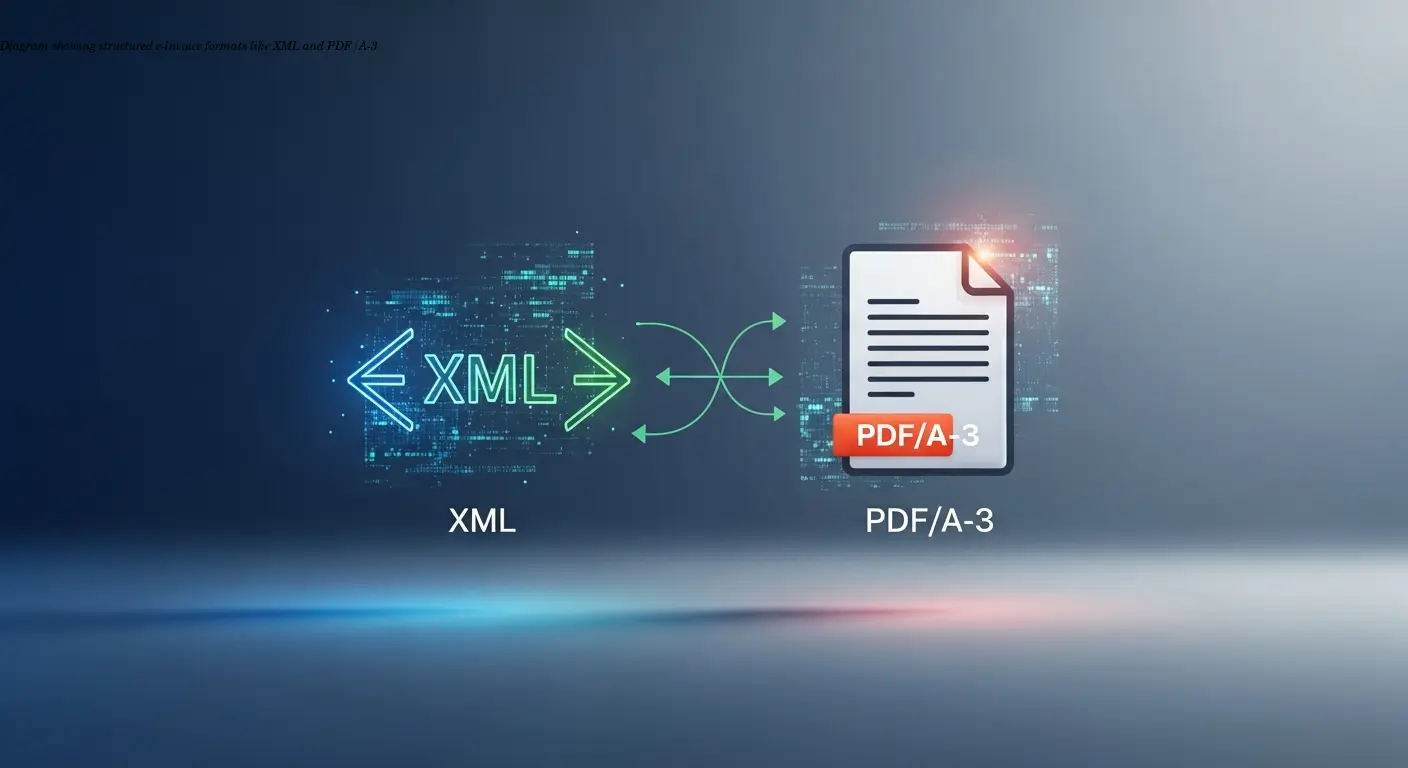

- E-invoices must be in structured, machine-readable formats such as XML or PDF/A-3 with embedded XML to be EU-compliant.

- The EN 16931 standard defines the mandatory data fields and technical rules used across EU member states.

- From 1 January 2025 Germany requires all B2B invoices to be electronic and compliant with EN 16931.

- Archive e-invoices in their original electronic format for 10 years (Germany) to meet legal requirements.

- Simple PDFs or scans don't count as compliant e-invoices — they must be automatically processable.

Understanding What Makes an E-Invoice EU-Compliant

Short answer: an EU-compliant e-invoice must be issued, transmitted, and received in a structured electronic format that is machine-readable and automatically processable.

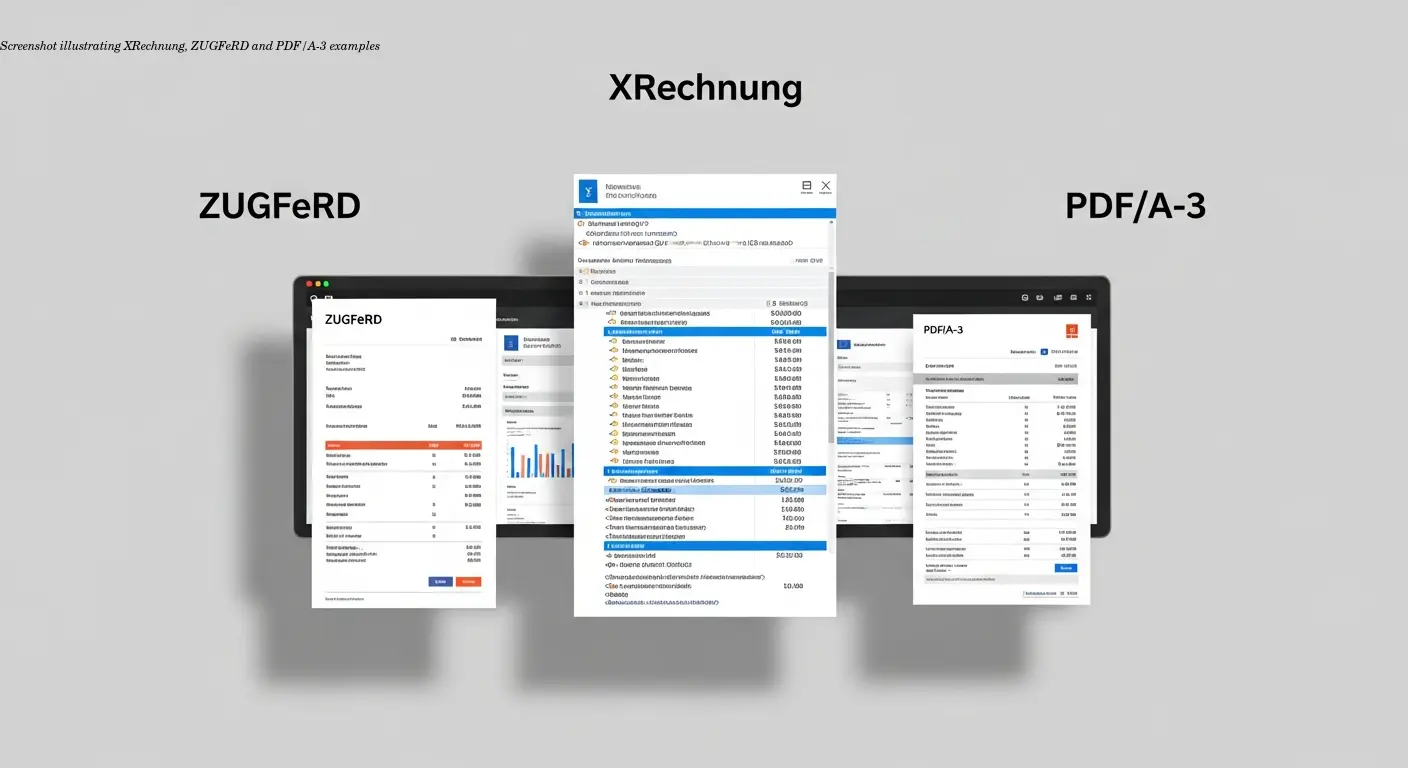

You can't simply save a Word doc as a PDF and assume it's compliant. The key formats are XML-based solutions like XRechnung or ZUGFeRD, and PDF/A-3 with embedded XML is an accepted option because it combines a human-readable visual layer with machine-processable data.

Compliance is not only about file type. It must guarantee three things:

- Authenticity of origin — proof of who sent it;

- Integrity of content — confirmation nothing changed during transmission;

- Legibility — readability for the entire archiving period.

Scanned invoices, JPEGs, TIFFs, and standard PDFs don't qualify as e-invoices under EU law because they aren't structured or machine-readable.

The EN 16931 standard is central: it defines the data elements and how they must be structured so invoices can be exchanged and validated across member states.

The Legal Framework You Need to Know

The legal momentum began with EU Directive 2014/55/EU, initially for public procurement. The VAT in the Digital Age (ViDA) initiative expands that concept toward mandatory B2B e-invoicing across the EU. Germany is enforcing mandatory e-invoicing from January 1, 2025.

Germany's E-Invoicing Ordinance (E‑Rech‑V) implements the directive nationally. Member states may add country-specific requirements atop EN 16931, so always verify local rules for any country where you operate.

From a policy perspective, structured e-invoicing helps prevent VAT fraud and improves tax collection efficiency by creating robust automated audit trails.

Essential Data Fields for Your E-Invoices

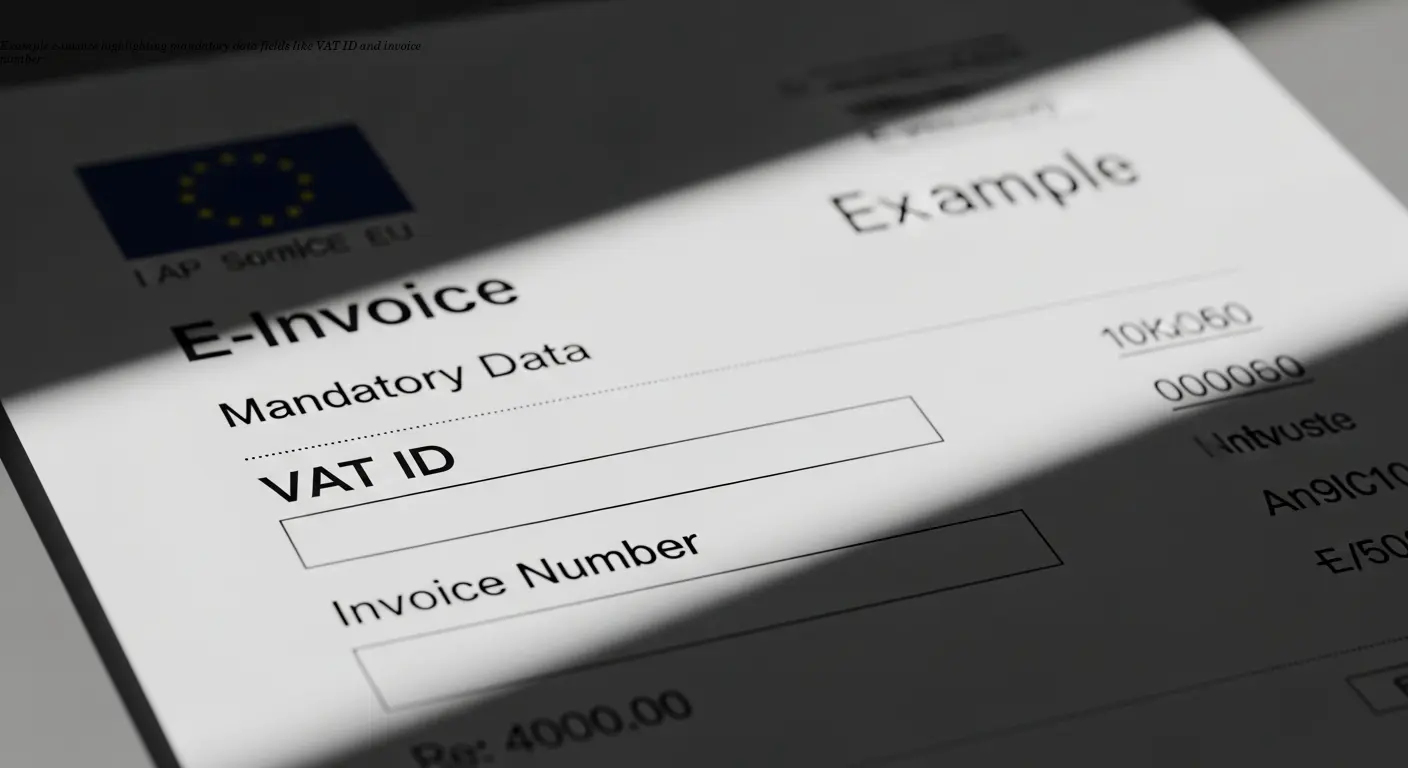

Missing a mandatory field can render an invoice non-compliant. The EN 16931-mandated data typically includes:

- Full legal names and addresses (provider and recipient — registered business names, not abbreviations).

- Tax number or VAT identification number for both parties (in correct national format).

- Invoice date and a unique, sequential invoice number.

- Line-item details: clear descriptions, quantity, unit price, and totals.

- Numeric amounts: net and gross values, tax rates, tax amounts, and any legal reference for exemptions.

- Payment details: payment terms, due date, IBAN/BIC if bank transfer is expected.

- Currency code: explicitly stated (e.g.,

EUR).

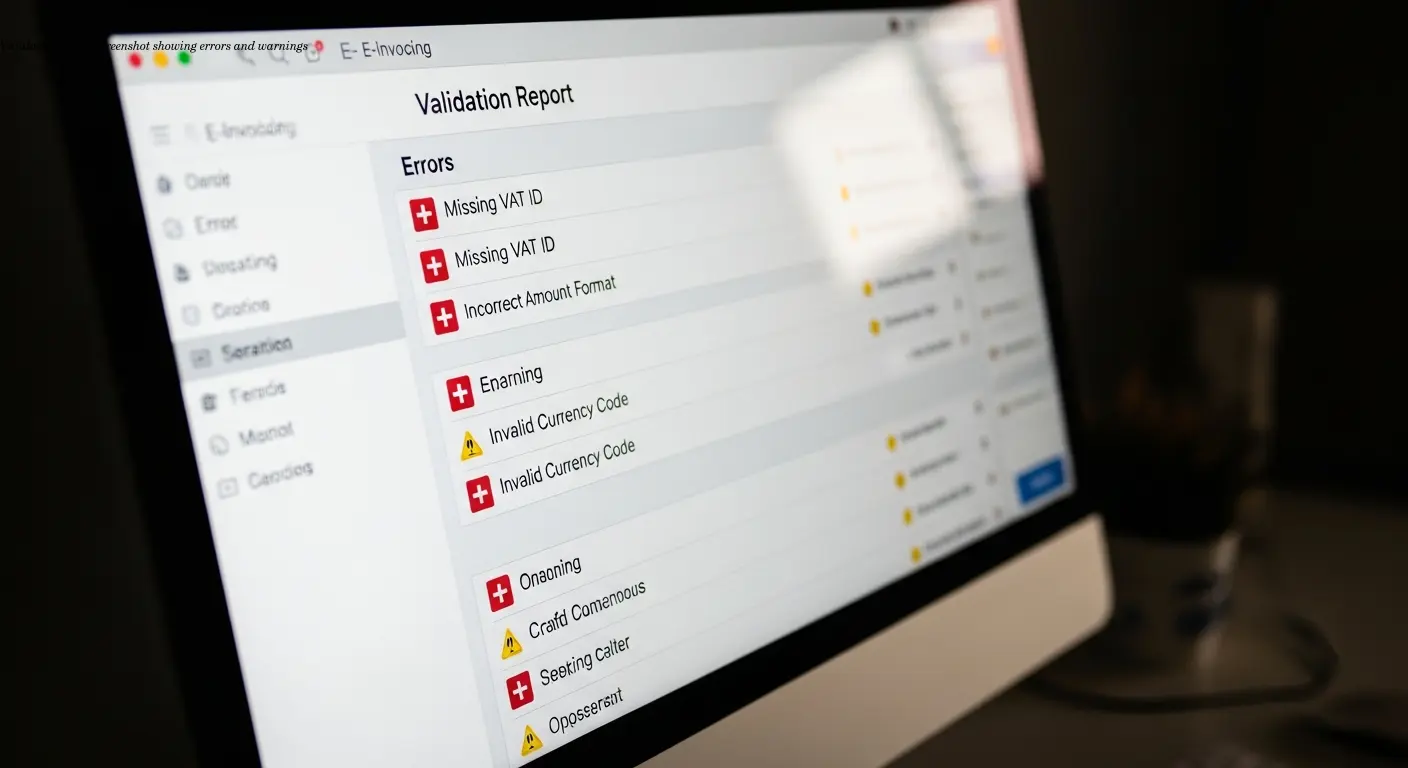

Even small formatting mistakes — wrong VAT number format, non-unique invoice IDs, empty currency fields — cause validation failures and costly rework.

Choosing the Right Format and Tools

You need tools that generate EN 16931-compliant formats. XML formats like XRechnung are common in Germany; ZUGFeRD and PDF/A-3 with embedded XML are alternatives that keep a readable PDF layer.

Check whether your accounting or ERP system explicitly supports EN 16931 — many require updates or modules. Online e-invoicing platforms can handle format generation, validation, and transmission for you.

Validation tools are essential. Use validators (the European Commission publishes validation artefacts) or third-party services to check technical structure and data content before sending.

If you need a simple starting point, consider using tools available at e-rechn.de which can simplify generation and compliance.

Setting Up Your E-Invoicing Process

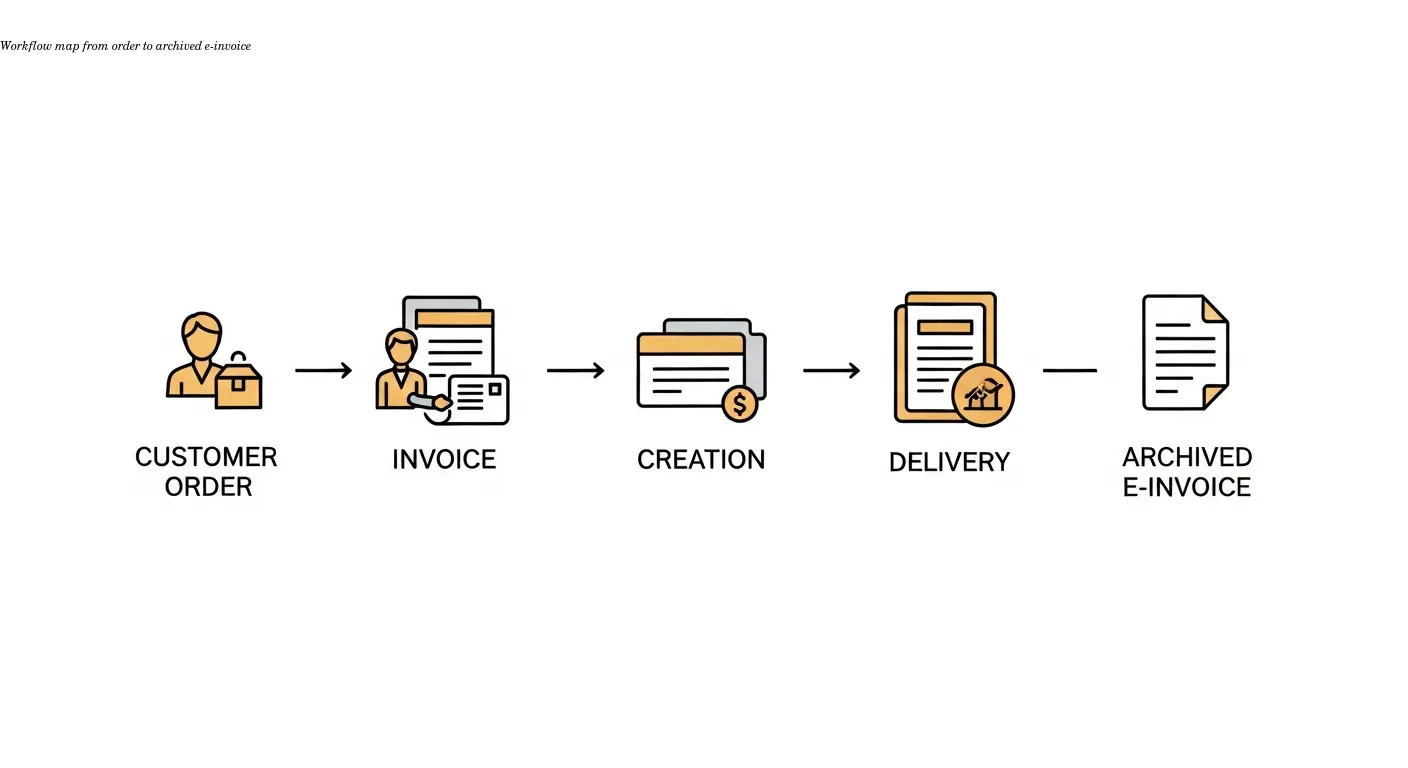

Implementation is process change, not just software. Map your current workflow from order to payment and identify where structured data must be captured and validated.

Training is critical: staff who create invoices must know which fields are mandatory and how to enter them. Use hands-on sessions and test invoices run through validators.

Templates reduce errors. Create templates for common transaction types (e.g., retail sale, warranty repair) that include all mandatory fields and prompts for variable data.

Transmission methods vary: emailing XML attachments, using Peppol, or uploading to a customer portal. Ensure the chosen method preserves authenticity and integrity.

Archiving: in Germany, retain e-invoices in their original electronic format for 10 years. That means the XML or PDF/A-3 file itself, not a printed copy.

Guaranteeing Authenticity and Integrity

Digital signatures provide cryptographic proof of origin and detect tampering. However, many e-invoicing platforms include signing and audit-trail features so you don't need to manage certificates yourself.

Audit trails document creation, edits, transmission, and receipt confirmations. Complement these with control procedures such as approval workflows and reconciliations.

Balance security with usability: overly complex signing processes can lead to workarounds that undermine integrity. Use reputable platforms, keep documentation, and train staff.

Validation and Quality Checks

Validate each e-invoice against EN 16931 before sending. Validators check XML structure and required data fields, catching missing VAT numbers, incorrect country codes, or calculation errors.

Automate validation within your workflow so it becomes a natural step rather than an optional check. Maintain simple documentation of common errors and fixes to speed up corrections.

Manual quality checks still matter: ensure the description matches the delivered goods or services and that customer details are current. Use sampling strategies based on transaction volume.

Practical Tips for Appliance Retailers and SMEs

Selling appliances across EU borders means dealing with cross-border VAT rules, languages, and different customer readiness for e-invoicing. Start by categorizing customers by readiness and needs.

- Communicate changes to B2B customers before switching to e-invoicing; some larger buyers have precise requirements for how they receive structured invoices.

- Prefer platforms for SMEs: they handle updates to standards and reduce technical burden.

- Keep backup procedures for downtime and know how to catch up legally when systems are restored.

- Stay informed about country-specific variations in EN 16931 implementations; or use a platform that manages them for you.

For many SMEs the fastest route to compliance is using an online e-invoicing platform. For example, consider tools available at e-rechn.de to handle technical compliance while you focus on running your business.

Frequently Asked Questions

Can I still use PDF invoices after January 1, 2025?

Standard PDF files don't meet EU e-invoicing requirements because they're not structured and machine-readable. You can use PDF/A-3 format with embedded XML data (like ZUGFeRD), which combines a visual PDF with compliant structured data. Simple PDFs will no longer be acceptable for B2B transactions in Germany and other EU countries implementing mandatory e-invoicing.

What happens if I send a non-compliant e-invoice?

Your customer may reject the invoice, requiring you to create and send a compliant version. This delays payment and creates extra work. More seriously, non-compliant invoicing could result in tax penalties or issues during audits. Tax authorities expect invoices to meet EN 16931 standards, and systematic non-compliance could trigger fines or detailed investigations into your business practices.

Do I need special software to create e-invoice documents?

You need software capable of generating EN 16931-compliant formats like XML or PDF/A-3 with embedded XML. Many modern accounting and ERP systems include this functionality, though you might need updates or additional modules. Alternatively, online e-invoicing platforms can generate compliant invoices without requiring expensive software installations. The key is ensuring whatever tool you use specifically supports EN 16931 compliance.

How long must I archive e-invoices?

In Germany, you must archive e-invoices in their original electronic format for 10 years. Other EU countries have similar requirements, though the exact duration might vary. The important point is archiving the actual electronic file (XML, PDF/A-3), not printing and storing paper copies. Your archiving system needs to ensure invoices remain readable and accessible throughout the retention period.

Are there different requirements for B2C versus B2B invoices?

Currently, mandatory e-invoicing requirements focus primarily on B2B transactions. B2C invoices (sales to consumers) generally aren't required to be electronic invoices yet, though you can issue them in compliant format if you choose. The requirements may expand to B2C in the future, so using compliant systems now prepares you for potential changes.

Can small businesses get exemptions from e-invoicing requirements?

Most EU countries implementing mandatory e-invoicing don't provide exemptions based on business size. Once the requirements take effect in your country, all businesses conducting B2B transactions must comply, whether you're a solo entrepreneur or a large corporation. Some countries might have transition periods or temporary relief measures, but the expectation is that all businesses will eventually comply.

What's the easiest way for SMEs to start with compliant e-invoicing?

Using an online e-invoicing platform designed for EN 16931 compliance is typically the easiest approach for SMEs. These platforms handle the technical details, format requirements, and validation automatically. You input your invoice data through a simple interface, and the system generates compliant XML files. This approach requires minimal technical knowledge and avoids the complexity of implementing and maintaining your own e-invoicing infrastructure.